Contact us today:

Contact us today:

Contact us today for a free consultation - if we take your case, there are generally no fees to you.

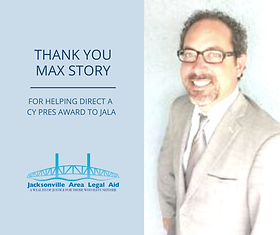

Attorney Story comes from a a strong military family and has been serving military clients for 20 years. His wife is a Tricare, VA and Humana Military Provider.

He serves as the Florida Chair of NACA, the National Association of Consumer Advocates. Considered an expert on Consumer Law issues, he speaks at numerous conventions and informative engagements.

We offer free zoom consultations throughout the state of Florida and nationwide for class action cases. We are admitted to Federal Courts in the North, Middle and Southern Districts.

Our beach office is located near Mayport Naval Station in Jacksonville Beach, Florida.

What is the Military Lending Act and what are my rights?

What is the Military Lending Act and what are my rights?

The Military Lending Act (MLA) is a Federal law that provides special protections for active duty servicemembers like capping interest rates on many loan products.Click this text to start editing. This block is a basic combination of a title and a paragraph. Use it to welcome visitors to your website, or explain a product or service without using an image. Try keeping the paragraph short and breaking off the text-only areas of your page to keep your website interesting to visitors.

What are my rights under the MLA?

What are my rights under the MLA?

Answer: The MLA applies to active duty servicemembers (including those on active Guard or active Reserve duty), spouses, and certain dependents. It limits the interest rates that may be charged on many types of consumer loans to no more than 36% and provides other important protections.

Your rights under the MLA include:

A 36% interest cap. You can’t be charged more than a 36% Military Annual Percentage Rate (MAPR), which includes costs like the following in calculating your interest rate (with some exceptions).

Finance charges

Credit insurance premiums

Add-on credit-related products sold in connection with the credit

Fees like application fees, participation fees, or fees for debt cancellation contracts, with some exceptions.

No mandatory waivers of certain legal rights. A creditor can’t require you to submit to mandatory arbitration or give up certain rights you have under State or Federal laws like the Servicemembers Civil Relief Act.

No mandatory allotments. A creditor can’t require you to create a voluntary military allotment in order to get the loan.

No prepayment penalty. A creditor can’t charge a penalty if you pay back part – or all – of the loan early.

What types of loans are now covered under the MLA?

What types of loans are now covered under the MLA?

Answer: In 2015, the Department of Defense (DoD) expanded by rule the types of credit products that are covered by the MLA. In general, the consumer credit products now covered when offered to active-duty servicemembers and their covered dependents include, but are not limited to:

- Payday loans, deposit advance products, tax refund anticipation loans, and vehicle title loans;

- Overdraft lines of credit but not traditional overdraft services;

- Installment loans but not installment loans expressly intended to finance the purchase of a vehicle or personal property when the credit is secured by the vehicle or personal property being purchased; and

- Certain student loans.

- For credit cards, creditors didn’t have to comply with DoD’s new rule until October 3, 2017.

What types of loans are NOT covered under the MLA?

What types of loans are NOT covered under the MLA?

Answer: There are some loans the MLA doesn’t cover – namely, credit that is secured by the property being purchased and certain other secured loans. These loans generally include:

- Residential mortgages (any credit transaction secured by an interest in a dwelling), including financing to buy or build a home that is secured by the home, mortgage refinances, home equity loans or lines of credit, or reverse mortgages;

- A loan to buy a motor vehicle when the credit is secured by the motor vehicle you are buying; and

- A loan to buy personal property when the credit is secured by the property you’re buying, like a home appliance.

If a loan does not comply with the MLA, can a creditor not give me the loan because I am an active duty servicemember?

If a loan does not comply with the MLA, can a creditor not give me the loan because I am an active duty servicemember?

Answer: Generally, yes. If the loan exceeds the 36% interest cap or if the loan violates other provisions of the MLA, creditors that give you the loan could be subject to penalties under the MLA.

Contact your local Judge Advocate General’s (JAG) office to learn more about lending restrictions and your rights as a servicemember.

Contact us today for a free consultation.

Contact us today for a free consultation.

If we take your case there are generally no fees to you.